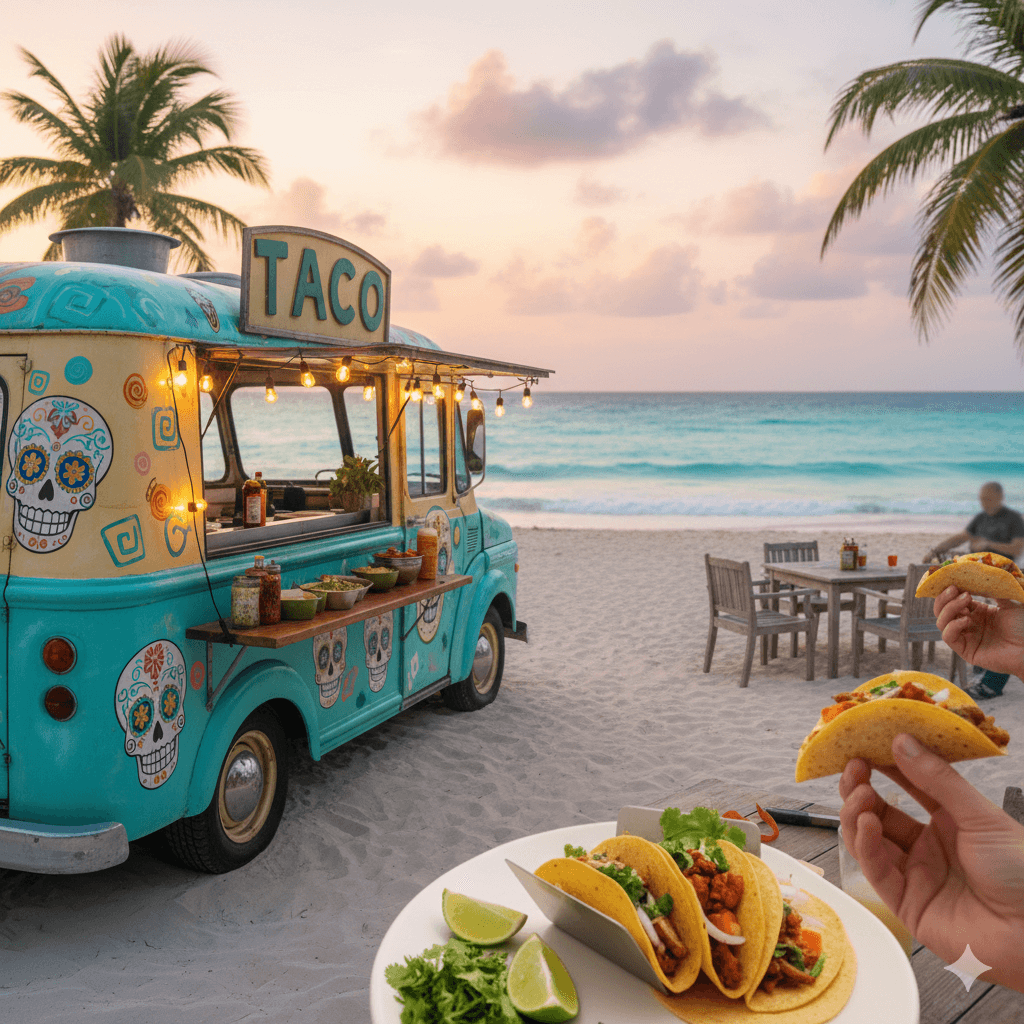

Picture searching for Cancun business help at 2am, wondering if this move becomes breakthrough or bust. We’ve guided expats just like you: Texas mom planning beachfront yoga spa, Canadian couple building authentic taco food truck. Lorad Law transforms that uncertainty into opening day success through targeted business consulting—company formation, tax IDs, zoning—avoiding $15k notary setbacks. Real Cancun attorneys speaking your language prevent STPS fines from derailing dreams.

Table of Contents

Business Consulting Mexico: End the Frustration

Company formation Mexico shocks expats with unreadable Spanish forms, bank rejections, legal rep confusion halting progress. No Mexican partner or large capital needed—just expert coordination. Lorad Law handles name approval, bilingual notary deeds ($1-3k USD), registry, Riviera zoning (no factories downtown).

Imagine selling everything back home, arriving in Cancun excited, then facing notary paperwork in Spanish, 40-day government delays, labor rules (REPSE) bringing 50k MXN penalties. Countless frustrated entrepreneurs face exactly this. Lorad Law provides market insights, entity guidance, SAT paperwork—completed in 2-4 weeks instead of endless months. The Canadian taco couple navigated Playa health permits; we handled zoning, labor compliance, ingredient imports—they’re thriving with weekend crowds.

Company Formation Mexico Foreigners: Chaos to Success

We’ve helped countless expats fulfill Mexican dreams, from Texas yoga studio owners securing beachfront permits to Canadian food truck couples dodging labor fines. Sarah poured savings into her spa vision, panicked over zoning blocks—we delivered uso de suelo approval and residency papers fast, turning sleepless stress into packed opening weekends.

Mexico Tax ID Explained: Unlock Your Bank Account

Foreigners struggle without proper tax ID—how to open business banking? Simple: RFC serves as your company’s Mexico ID number, created during formation so banks finally approve. Without it, no vendors or payroll possible. Lorad Law activates RFC plus e.firma digital signature right in setup; connect residency CURP for legal rep needs. Our RFC breakdown for expats shares straightforward steps—Canadian taco owner started payments day one, avoided all banking delays.

Best Companies for Foreigners in Mexico: Smart Choices

Selecting wrong entity leads to costly restarts. S.A. de C.V. (similar to US corporation) supports growth—banks favor it, accommodates up to 50 owners for investors. S. de R.L. de C.V. maintains privacy for family/small teams with simpler operations. Both enable 100% foreign ownership; temporary residency qualifies as legal rep. Texas spa expanded confidently with S.A. de C.V.; we drafted bylaws safeguarding control while accelerating loans as part of our Business Consulting services that we have built through years of experience in the Mexican Riviera.

Corporate address requires utility bill verification—no PO boxes accepted.

Riviera Maya Real Talk: Hidden Challenges

Cancun and Playa welcome businesses but enforce tourism zoning—no industrial downtown; STPS requires labor contracts beyond 15 staff. Skip utility proof and lose address validity. Lorad Law’s local team resolves SUPMEX issues daily, includes IMSS insurance, supports capital growth. Canadian taco food truck passed Playa inspections cleanly, we even helped them get their driver´s permit!. We also prepared the REPSE documents, temp residency verified—completely seamless.

FAQs: Expat Business Questions Answered

Can foreigners own 100% of a Mexico company?

Yes—both S.A. de C.V. and S. de R.L. de C.V. allow complete foreign ownership in most sectors. Temporary residency qualifies you as legal representative; no Mexican partner needed.

What’s the fastest timeline for company formation?

Lorad Law completes full setup (notary to RFC activation) in 2-4 weeks versus 2-3 months solo. Includes zoning verification and bank account readiness.

Do I need RFC before opening a bank account?

Absolutely—RFC is your company’s tax ID required for banking, vendors, payroll. We generate and activate during formation so you’re operational immediately.

Tourist visa holders can start businesses?

No—requires temporary residency to serve as legal rep. We coordinate immigration alongside formation for seamless transition.

What are REPSE/STPS requirements?

Mandatory labor registry prevents 50k MXN fines; needed for outsourcing or 15+ staff. Lorad Law registers during setup with STPS Joint Commission compliance.

Any minimum capital requirement?

None legally—50k MXN recommended to show bank seriousness. No actual deposit needed upfront.

Lorad Law: Expats Who Triumphed (Join Them)

Texas spa owner escaped corporate burnout for Cancun wellness—we blocked her $15k entity redo and had doors open in 21 days. Canadian couple swapped winters for Playa taco food truck—dodged 50k MXN labor fines, now locals queue every weekend.

Your breakthrough awaits: targeted market analysis, seamless company formation (notary through RFC), complete tax/labor compliance, zoning success—no hidden fees, just results.