The 2025 payment season for Mexico’s property tax, the Predial, is now open. For foreign owners, this is the time to secure significant discounts and ensure compliance. This article provides the specific dates, rates, and steps you need to pay your 2025 bill.

Table of Contents

Predial 2025 Discounts and Deadlines for Key Expat Areas

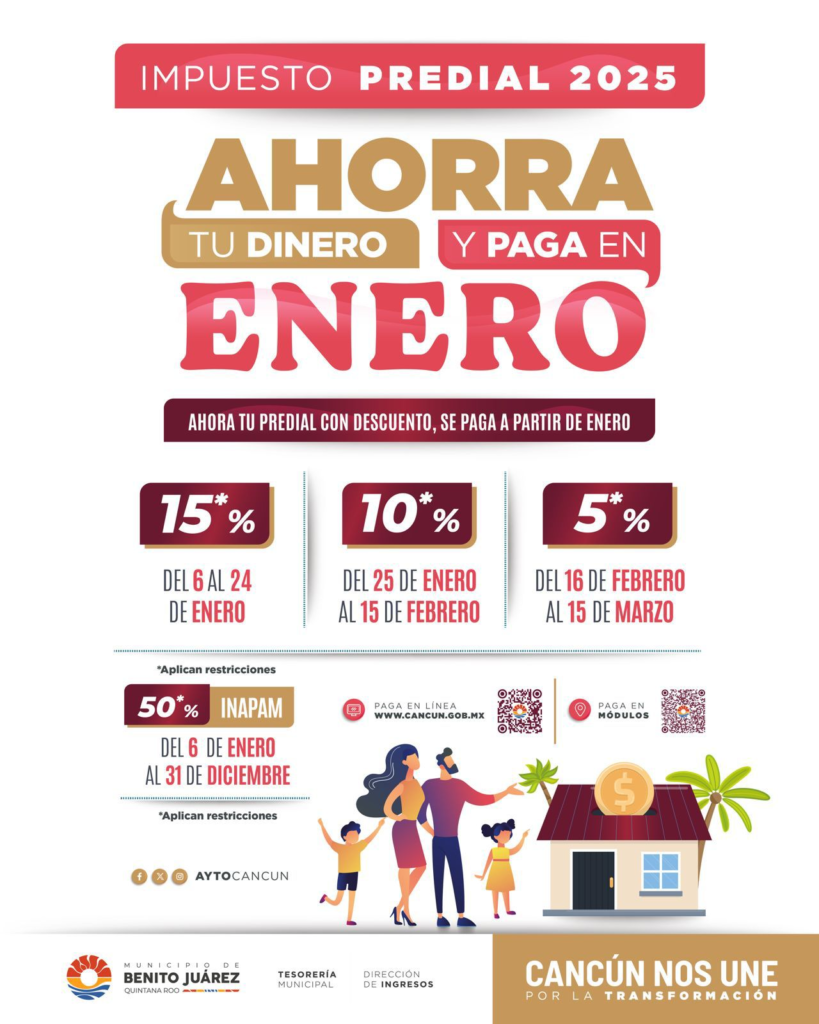

Paying early is the most effective way to reduce your tax bill. Below are the 2025 discount schedules for municipalities popular with foreign owners. These discounts are typically applied automatically if you pay within the designated window.

| Municipality / State | 2025 Early Payment Period | Maximum Discount |

|---|---|---|

| Benito Juárez (Cancún, Quintana Roo) | January 1 – February 28 | 25% |

| Solidaridad (Playa del Carmen, Quintana Roo) | January 1 – February 28 | 20% |

| Tulum (Quintana Roo) | January 1 – March 31 | 15% |

| Puerto Vallarta (Jalisco) | January 1 – February 28 | 10% |

| Los Cabos (Baja California Sur) | January 1 – February 28 | 20% |

Note: Discounts often decrease monthly. Paying in January typically yields the highest savings.

How to Pay Your 2025 Predial Tax Online: A Step-by-Step Guide

For most foreign owners, paying online is the most efficient method. You will need your property’s folio number (clave catastral), found on a previous bill or your property deed.

- Navigate to the Official Portal: Search for “Tesorería de [Your Municipality]” (e.g., “Tesorería de Benito Juárez”).

- Locate the Payment Section: Look for a button or link labeled “Pago de Predial” or “Trámites y Servicios.”

- Enter Your Folio Number: Input your 100% correct clave catastral.

- Verify the Amount: The system will display the total due, including any applied early payment discount. Confirm the amount is correct.

- Submit Payment: Pay using a credit or debit card. You will receive a digital receipt (comprobante de pago).

Save this receipt permanently. It is your only proof of payment and is required if you sell your property.

What to Do If You Have Lost Your Property Folio Number

If you cannot find your clave catastral, you have two options:

- Visit the local tax office (Tesorería) in person with a copy of your ID and property deed. They can look it up for you.

- Our law firm can retrieve this number for you as part of our payment management service.

💡 Understanding your full legal obligations is key to protecting your investment. For a deep dive into the Predial system, including how to formally challenge your property’s tax value and other legal strategies, read our detailed article: Mexico’s Predial Tax for Foreigners: Calculation, Discounts, and Legal Tips.

Consequences of Missing the Predial 2025 Payment Deadline

Failing to pay your Predial after the discount period ends results in:

- Loss of Discount: You will owe the full, undiscounted amount.

- Monthly Penalties: You will be charged late fees and accruing interest on the outstanding balance.

- Eventual Lien: Persistent non-payment can lead to a legal lien on your property, blocking its sale.

🆔 For a clear breakdown of the Mexican property tax system, including how your cadastral value is determined and your long-term obligations, read our foundational guide: Property Taxes in Mexico: What Foreign Owners Need to Know.

Frequently Asked Questions for the 2025 Tax Year

Can I pay my 2025 Predial if I am outside of Mexico?

Yes. The best method is to use your municipality’s official online payment portal. These sites generally accept international credit or debit cards. If you encounter issues, our firm can process the payment on your behalf from within Mexico.

What happens if I don’t pay my Predial before selling my property?

You cannot sell your property with an outstanding Predial debt. The notary public will require a “certificate of no debt” (certificado de libertad de gravamen) to finalize the sale. Any unpaid taxes, plus penalties, must be settled in full before this certificate can be issued.

I own through a fideicomiso. Do I pay the Predial differently?

No. The payment process is identical. You are responsible for the tax, and you pay it directly to the municipality using the same online or in-person methods. The bank trust does not change this.

What is the consequence of an incorrect cadastral value on my 2025 bill?

An incorrectly high cadastral value means you overpay every year. While you can challenge this value, the process must be initiated with the municipal authorities and can take time. For the 2025 bill, it is crucial to pay the assessed amount by the deadline to avoid penalties. You can then pursue a correction for future years with legal assistance to potentially lower your long-term tax burden.

Need Help with Your 2025 Predial Payment?

Managing this from abroad or navigating foreign government portals can be challenging. Let our bilingual legal team handle it for you.

Our 2025 Predial Service includes:

- Verification of your cadastral value and tax amount.

- Secure payment to ensure you receive the maximum available discount.

- Digital delivery of your official payment receipt for your records.

Ensure your property remains in good standing. Contact Lorad Lawyers to manage your 2025 Predial payment securely and efficiently.