For many Americans and Canadians, the dream of owning a sun-drenched condo in Playa del Carmen or a tranquil villa in Los Cabos is a key part of their retirement or investment strategy. But in 2025, navigating the financing landscape can feel complex. How do you get a mortgage in Mexico as a foreigner? This definitive guide cuts through the complexity, explaining not just the ‘how,’ but the ‘why’—including the crucial legal steps like obtaining your CURP and RFC that are the foundation of your financial identity in Mexico.

Table of Contents

Why a Mexican mortgage is a smarter strategy than ever in 2025

While paying cash is a straightforward path, financing your property offers strategic advantages that savvy investors are leveraging in 2025:

- Preserve Your Financial Flexibility: Don’t tie up your entire retirement savings or liquid capital into a single asset. A mortgage allows you to keep funds available for other investments or opportunities.

- Leverage for a Better Property: A strategic down payment can help you acquire a more valuable property in a prime location, leading to higher potential appreciation and rental income.

- Built-In Due Diligence: A lender will conduct a thorough appraisal and will not release funds until they confirm the property’s title is free and clear within your fideicomiso, giving you a powerful second layer of legal protection.

- Potential Tax Advantages: The interest paid on a Mexican mortgage may be tax-deductible against your Mexican-sourced rental income, a valuable advantage to discuss with your accountant.

The Non-Negotiable First Step: Securing Your Mexican Financial Identity (CURP & RFC)

Before any lender can process your application, you must have the two essential keys to the Mexican financial and legal system. This is where many applicants get stuck, and where Lorad Law provides invaluable expertise.

- CURP (Clave Única de Registro de Población): This is your unique population registration number. It’s required for almost all official procedures, from opening a bank account to signing a formal sales contract. Think of it as your Mexican social security number.

- RFC (Registro Federal de Contribuyentes): This is your Mexican tax ID. The mortgage bank will require it to process your loan and report the financial activity to the SAT (Mexico’s IRS). It is non-negotiable for any financial transaction.

At Lorad Law, we integrate this crucial first step into our service, ensuring you obtain your CURP and RFC efficiently and correctly, setting a solid foundation for your application.

How your Mexican fideicomiso and mortgage work together

If you’re buying within Mexico’s Restricted Zone (50km from the coast, 100km from borders), a fideicomiso (bank trust) is mandatory. Here’s the critical connection most guides miss: Your mortgage lender will be listed as the first beneficiary of your fideicomiso until the loan is paid in full. This is how they legally secure their investment.

Once the mortgage is settled, the first beneficiary status is removed, and you remain as the sole beneficial owner with all rights of use and enjoyment. Understanding this relationship is crucial for a smooth and secure transaction.

Navigating your mortgage options in 2025

The best financing route for you depends on your residency status, financial background, and long-term goals. In 2025, foreigners typically access mortgages through three main channels, each with distinct advantages and requirements. The following table breaks down these options to help you identify the best fit for your situation.

| Option | Best for | Pros | Cons |

| International lenders | Most foreigners, no residency needed | Process based on US/Canadian credit history. English-speaking support. | Rates may be slightly higher than Mexican banks. |

| Mexican Bank Mortgage | Foreigners with permanent residency | Most competitive interest rates available. | Requires an established Mexican credit history and residency. |

| Developer Financing | Buying new construction directly | Often offers promotional rates. Process is streamlined by the developer. | Limited to specific properties and projects. Less flexibility. |

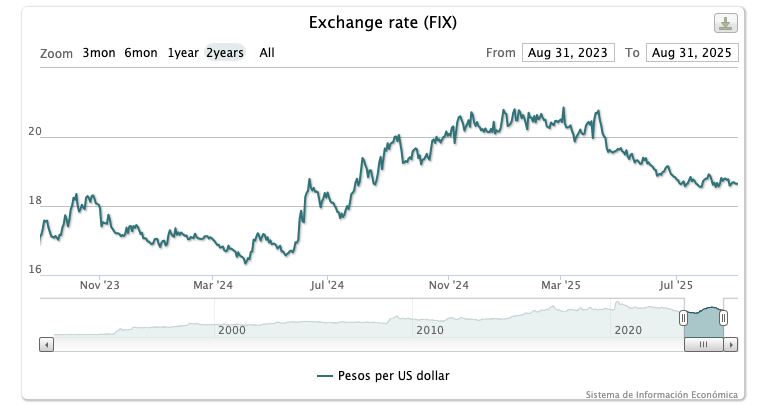

It’s important to understand that mortgage rates in Mexico are often based on the Tasa de Interés Interbancaria de Equilibrio (TIIE), a benchmark rate set by the Bank of Mexico (Banxico). Fluctuations in this rate will directly impact the interest you pay.

The Step-by-Step Mortgage Process in 2025

Knowing what to expect eliminates stress. Here is the typical journey from pre-qualification to receiving your keys:

- Pre-Qualification: Get a preliminary, non-binding assessment of your budget from a lender.

- Secure Your CURP & RFC: This is your foundational step. Without these, you cannot proceed.

- Property Selection & Offer: Find your home and sign a purchase agreement with a contingency for financing.

- Formal Application: Submit the full application package to your chosen lender (proof of income, bank statements, passport, etc.).

- Property Appraisal: The lender will send an appraiser to determine the official market value of the property.

- Fideicomiso Approval: The bank’s trust department reviews and prepares the trust agreement, naming the lender as the first beneficiary.

- Underwriting & Final Approval: The lender’s committee reviews the entire package and issues a final, formal loan approval.

- Signing Before the Notario: The official closing where you, the seller, and bank representatives sign the fideicomiso and loan documents. This is a legal requirement.

- Funding & Registration: The lender disburses the funds to the seller, and the purchase is officially recorded in the Public Registry of Property.

Required Documents: Get your papers ready for 2025

Preparation is key. Having these documents ready will significantly speed up your application:

- Valid Passport & Current Mexican Visa (e.g., Temporary Residency)

- Proof of Income (Recent tax returns, 6+ months of bank statements, pension statements)

- Your CURP & RFC Numbers

- Proof of Address (from your home country and/or from Mexico)

- Signed Sales Purchase Agreement for the property

The Lorad Law Advantage: Your bilingual legal experts

Navigating a mortgage in a new country requires a guide who understands both the law and the finance. Lorad Law provides an integrated service that sets us apart:

- We Secure Your Foundation: We handle the entire process of obtaining your CURP and RFC, avoiding costly delays.

- We Demystify the Process: We explain the fideicomiso and mortgage relationship in plain English, ensuring you understand every step.

- We Connect You with Confidence: We leverage our trusted network to connect you with vetted lenders offering the best terms for your unique situation.

- We Handle the Legalities: Our expert legal team manages all contracts and notario procedures, ensuring your investment is protected from offer to closing and beyond.

Do I need Mexican residency to get a mortgage?

Not necessarily. While traditional Mexican banks often require residency, many international lenders operating in Mexico in 2025 will approve loans based on your strong Canadian or American credit history and income, without requiring residency first.

Can I get a mortgage for a property held in a fideicomiso?

Absolutely. In fact, it’s the standard process. The mortgage is secured through the fideicomiso structure, with the lender named as the first beneficiary until the loan is retired. This is a secure and well-established practice.

How does my CURP affect the mortgage process?

Your CURP is your primary ID number for all government and financial processes in Mexico. A lender cannot open a formal application file without it. It is the very first step in the journey and is non-negotiable.

What are the typical down payment requirements in 2025?

For foreigners, down payments typically range from 30% to 40% of the appraised value of the property. The exact amount depends on the lender, the property type, and your overall financial profile.

What are the current interest rates like?

Rates can vary between lenders and are based on your financial profile. As of 2025, rates for foreigners typically range from 8% to 11% APR. During your consultation, we can provide more specific, current information based on your situation.

Why shouldn’t I just use equity from my home back in the U.S./Canada?

You can, and many do. However, taking out a mortgage in Mexico allows you to keep your existing equity liquid, potentially at a lower cost than refinancing your primary home, and provides all the strategic advantages and legal safeguards outlined in this guide.

Ready to Unlock Your Dream? Let’s Talk Numbers

Stop wondering if you qualify. The Mexican market in 2025 is full of opportunity for prepared investors. Schedule a free, no-obligation Financing Consultation with a Lorad Law expert today. We’ll assess your situation, connect you with the right lending partners, and outline a clear, confident path to owning your perfect property in Mexico.