Our legal experts in Mexico understand what every foreigner goes through when trying to understand this country. Mexico’s tax and legal systems are essential for individuals and businesses but that doesn’t mean they aren’t complex. One popular word that pops up in every conversation when our clients mention Mexico is: Will I need a Mexican RFC?

Keep reading this post and you will understand why the RFC in Mexico is a critical identifier used for tax and administrative purposes, we’ll break down what the RFC is, its significance, and how to get your RFC number without doing the bureaucratic dance.

Table of Contents

How to Get a Mexican RFC Number

Securing your RFC number may seem challenging, especially if your first language isn’t Spanish. However, the easiest and most efficient way to deal with this process is by seeking assistance from a legal expert, ensuring accuracy and compliance at every step. But before getting one, you must understand what is an RFC and why it is important in Mexico.

What is the RFC in Mexico?

The Registro Federal de Contribuyentes (RFC), or Federal Taxpayer Registry, is a unique identification number assigned to individuals and businesses by Mexico’s tax authority, the Servicio de Administración Tributaria (SAT), Mexico’s version of the IRS. This number is essential for:

- Filing taxes.

- Issuing and receiving electronic invoices (Facturas).

- Conducting financial transactions, including opening bank accounts.

- Setting up utilities and legal documents.

What is the SAT in Mexico?

The Servicio de Administración Tributaria (SAT) is Mexico’s regulatory body for tax collection, enforcement, and compliance. As the main institution behind the RFC, the SAT plays a central role in managing tax obligations for individuals and businesses. Hacienda also handles the issuance of electronic invoices (Facturas), regulates financial transactions, and ensures that national and international taxpayers meet their legal responsibilities. Easier said than done in a country as big as Mexico!

Whether you’re applying for a Mexican RFC or managing business operations, understanding what the SAT wants from you is crucial to having the best experience possible as part of this country. Fortunately, our legal experts can help you understand any fiscal issue you may have.

Who Needs an RFC in Mexico?

If you’re wondering, “Do I need an RFC number in Mexico?”, the answer depends on your activities in the country:

- Individuals: Residents earning income, owning property, or conducting significant financial transactions require an RFC.

- Foreigners: Non-Mexican residents often need an RFC for activities like opening a bank account, purchasing property, or conducting business.

- Businesses: All entities operating in Mexico must have an RFC to comply with tax laws.

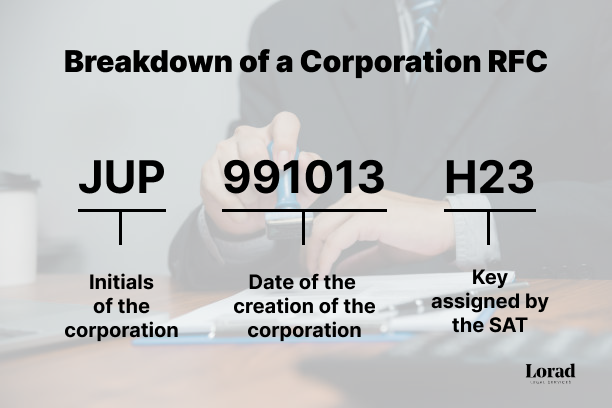

Breaking down the Mexican RFC Number

The structure of a Mexican RFC number provides important details about the taxpayer. Each segment of the RFC represents specific information:

- First Four Characters: These are derived from the taxpayer’s full name or business name, often combining the first letters of the last names and first name.

- Date of Birth or Company Creation: The next six digits indicate the individual’s birthdate (YYMMDD) or the company’s date of establishment.

- Homoclave: A unique three-character code assigned by the SAT to distinguish taxpayers with similar names or dates.

This breakdown ensures the RFC is unique to each taxpayer, enabling precise identification for tax and administrative purposes. Displaying a visual guide helps clarify how the RFC reflects personal or business information, making it easier for individuals and companies to understand its components.

Who can apply for an RFC in Mexico?

Anyone conducting taxable activities in Mexico, including individuals, foreigners, and businesses, is eligible to apply for an RFC. If you are starting a new business, purchasing property, or earning income, obtaining an RFC is a vital step in staying compliant with Mexican law.

Steps to Apply for an RFC

- Gather Required Documents:

- Valid ID (passport for foreigners).

- Proof of address.

- CURP (Clave Única de Registro de Población) for individuals.

- Business documents for companies.

- Visit the SAT Website: You can start your application online via the SAT portal. Foreigners often ask, “How can I get my RFC number online in Mexico?”, and the portal simplifies the initial process.

- Complete the Online Form: Enter your personal or business details to generate a preliminary RFC.

- Finalize at a SAT Office: Bring your documents to a local SAT office for verification and receive your official RFC.

Is an RFC the same as a CURP?

No, the RFC and CURP serve different purposes. While the CURP is a unique population registry code used for identification, the RFC is specifically for tax-related activities. Both may be required for certain transactions, but they are distinct identifiers. Yes, we understand it is confusing, but remember, we can help you out!

In simple terms: The CURP tells the government who you are, while the RFC tells the government what you do economically.

The Direct Relationship

The key relationship is in the format for individuals:

- The RFC for an individual is built directly upon the foundation of their CURP.

- The first 10 characters of a person’s RFC are identical to the first 10 characters of their CURP.

- The SAT then adds a unique 3-character homoclave to create the full 13-character RFC. This homoclave ensures that if two people were to have the exact same first 10 characters (an extremely rare occurrence), they can still be distinguished for tax purposes.

| Feature | CURP | RFC |

| Full name | Clave Única de Registro de Población | Registro Federal de Contribuyentes |

| Purpose | Identification (Statistical, demographic) | Taxation (Fiscal, economic activities) |

| Issued to | Every single person associated with Mexico | Only individuals & entities with tax obligations |

| Issued by | SEP / RENAPO / SAT | SAT (Tax Administration Service) |

| Format | 18 characters | 13 characters for individuals; 12 for companies |

| Example | PEGJ800415HNLRRN09 | PEGJ800415XXX |

If you want to know more about what a CURP is, check out our blog post about the subject, and you can even take a test to see if you are eligible for a CURP.

Do I need an RFC number if I have property in Mexico?

Yes, owning real estate in Mexico often requires having an RFC. You will need to have an RFC in Mexico to be able to pay property taxes, issue receipts for rental income, and even set up utilities in your name. Without an RFC, managing these legal and financial obligations can become quite a challenge, and, the SAT will definitely not be thrilled.

What happens to an expat doesn’t have an RFC number in Mexico?

Expats living in Mexico who fail to obtain an RFC may face several challenges:

- Limited Access to Services: Opening bank accounts, buying property, or setting up utilities may be difficult without an RFC.

- Tax Compliance Issues: Expats earning income or conducting business in Mexico could face penalties for non-compliance.

- Missed Opportunities: The inability to issue or receive Facturas can hinder business and financial transactions.

Conclusion

The RFC Mexico is more than just a number—it’s a gateway to legal and financial participation in the country. Whether you’re a foreigner wondering, “How do I get my RFC in Mexico?”, or a business navigating tax compliance, understanding the RFC process is vital.

Need help? Contact our experts today for seamless assistance in obtaining your RFC and ensuring full compliance with Mexican regulations.

Pingback: Find Out if You Need a CURP for Mexico residency - Lorad Law